Institutional Investment Management (Endowments, Foundations, Trusts & Corporations)

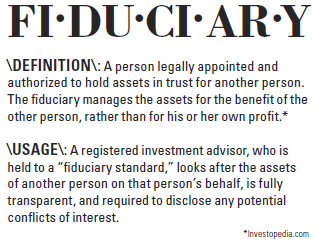

As a board member or trustee, you have a fiduciary responsibility to manage and shepherd the assets entrusted with you. As the assets in your foundation or endowment grow, they require more sophisticated and hands-on management---which may be beyond the abilities of the board members. You can mitigate risk and fulfill your fiduciary duties by outsourcing your asset management to Olympic Financial Advisors, LLC.

Investment Policy

We'll first work together to develop a comprehensive investment policy document (or review your policy, if one already exists). This policy, which may incorporate a formal spending policy as well, provides your board with a blueprint to assist in future investment and asset distribution decisions. It will include an assessment of your goals, objectives, time horizon and risk tolerance.

Portfolio Management

Working within the parameters outlined in the investment policy and utilizing the tenets of Modern Portfolio Theory and the Efficient Frontier, OFA will recommend and implement positions in a diversified portfolio and provide continuous and regular supervision of this portfolio. In alignment with your fiduciary responsibilities, the portfolio will focus heavily on low-cost, efficient investments.

Ongoing portfolio management responsibilities will include:

- Investment selection and execution of trades

- Quarterly in-person reporting to your board

- Re-balancing the portfolio in accordance with investment policy parameters

- Reallocate the portfolio due to changes in the economy, of the board's objectives, or performance of the investments

- Ongoing monitoring

- Annual written report and summary of performance versus market conditions

Contact us today to schedule a complimentary initial meeting to discuss your situation and goals.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.